Calculate depreciation on furniture

Other changes applied as well. Office furniture and equipment.

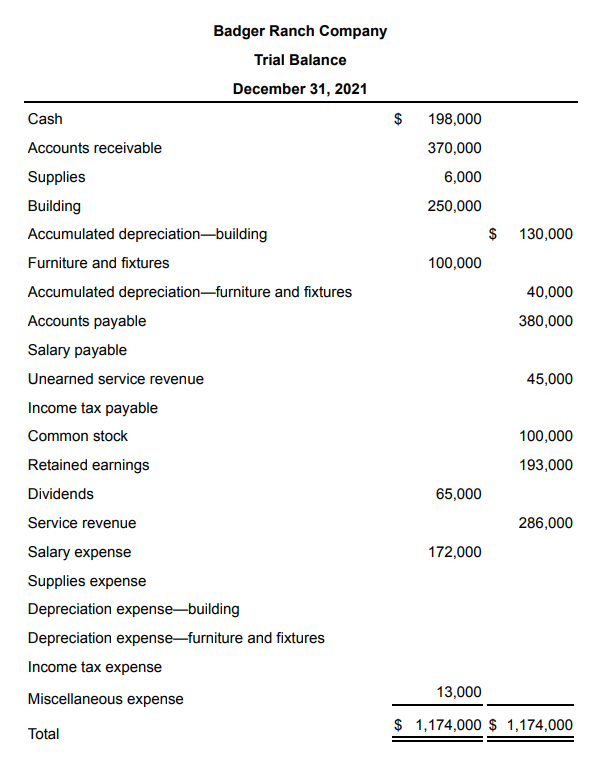

Solved A B C D Supplies On Hand At Year End 2 000 Chegg Com

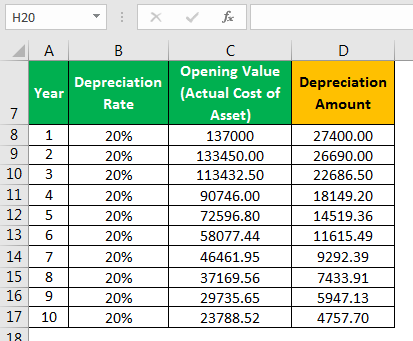

You can now calculate depreciation for each year of the life of your asset by taking the depreciable basis times the rate from the table.

. Your organizations financial teams will want to know equipment depreciation rates and record that data on income and balance statements. Because the federal government seeks to incentivize businesses using solar technology it offers a desirable depreciation schedule. In year 5 there is no need to calculate depreciation.

There are 4 main criteria used to calculate depreciation. This allows for 75 percent of the first years depreciation to be declared which would reduce the deduction in the first year to 3750The deduction would be 5000 for the remaining six years. In year 4 calculate depreciation of 16 to reduce the final value to 200.

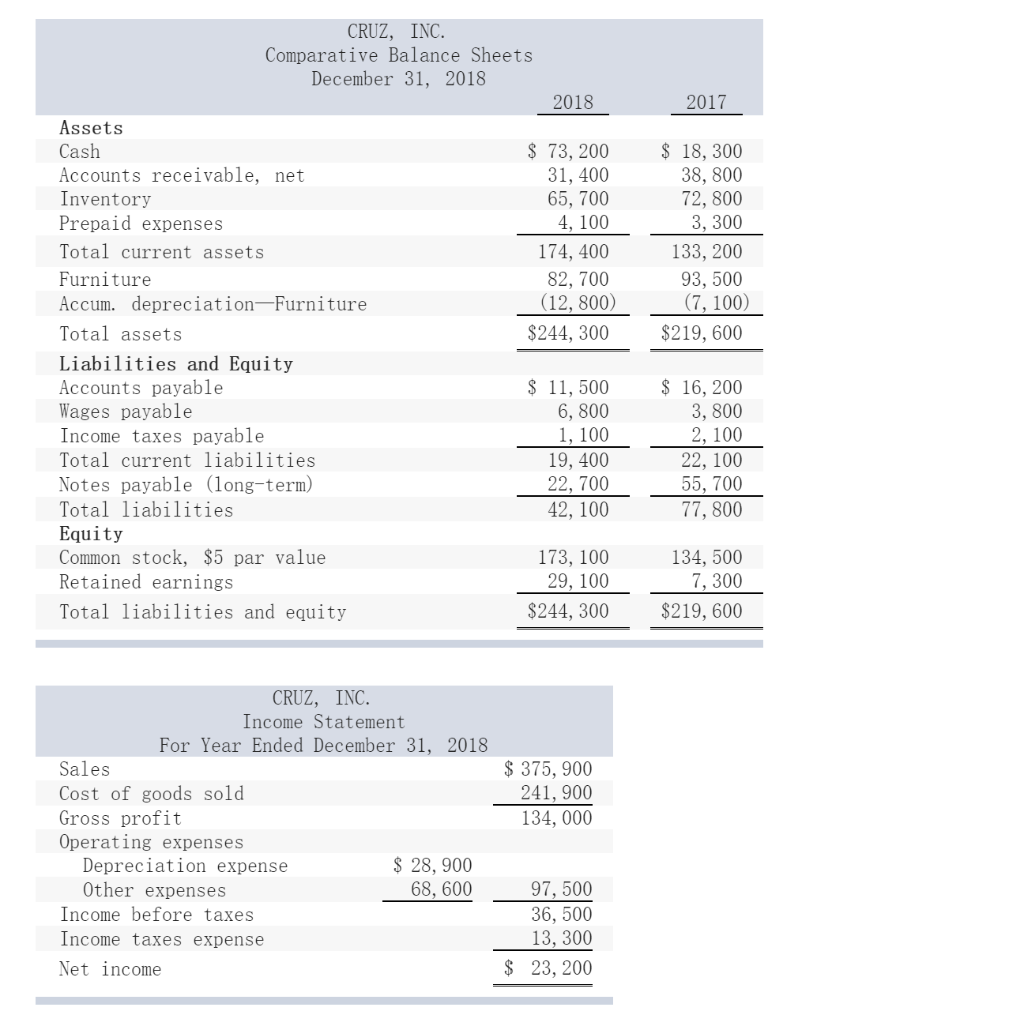

An example of fixed assets are buildings furniture office equipment machinery etc. Lets calculate the depreciation. In this example the equipment cost 2 million and had an estimated useful life of 10 years.

Rather than try to learn all the intricate details its a good idea to let your tax. Here we learn how to calculate earnings before interest tax depreciation and amortization using its formula along with examples. This is an accelerated depreciation method that expenses more depreciation at the beginning of the life of an asset than at the beginning.

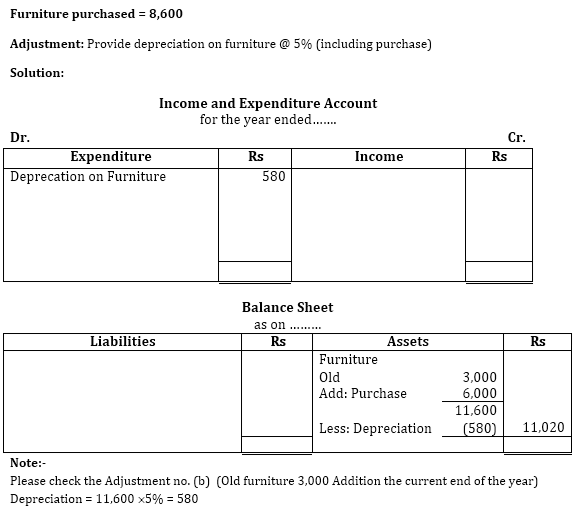

Calculate depreciation for each property type based on the methods rates and useful lives specified by the IRS. In this example if the furniture is put into service for a business during the first applicable tax year the half-year convention is applied. Calculating depreciation on furniture is the same as calculating depreciation on any other asset like machinery or vehicle.

The salvage value is 200. As mentioned assets like office furniture depreciate at varying rates. After filling out the order form you fill in the sign up details.

The first chart the MACRS Depreciation Methods Table tells you your Toyota is a non-farm 3- 5- 7- and 10-year property and that you use the GDS 200 method to calculate how much tax to deduct. Also assume your employer offers you three sick days nine vacation days and four days of paid time off. In addition to depreciating the building real estate investors can also depreciate items placed into service in a rental property faster than 275 years.

If you find that you cannot repair or replace damaged or destroyed items for the replacement cost established on your estimate please contact your Claim. Updated Study Notes and Revision Kits MASOMO MSINGI PUBLISHERS. Therefore to calculate the value of this benefit you would first calculate your average daily pay 20 x eight hours a day 160.

Using straight-line depreciation calculate the annual depreciation by dividing the original cost by the number of years in useful life. You use the furniture only for business. Determine your cost basis.

Ensure you request for assistant if you cant find the section. In general sick days vacation days and paid time off are paid as if you worked a full day and got paid. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2700000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2022.

Appendix A includes three different tables used to calculate a MACRS depreciation deduction. When you are done the system will automatically calculate for you the amount you are expected to pay for your order depending on the details you give such as subject area number of pages urgency and academic level. This is the annual depreciation amount.

Furniture expense around 20 of the overall value a year with a full write-off over 5 years. The only difference is the depreciation rate of the asset and the useful life Useful Life Useful life is the estimated time period for which the asset is expected to be functional and can be put to use for the companys. Penny is an American furniture.

This is the easiest and most simple way to calculate depreciation. For example double-declining depreciation for asset with a 10-year life would be 2 x 10. This rate is found by multiplying the straight line percentage of depreciation.

If you purchase a 15-inch laptop for 1500 and submit a request for recoverable depreciation you will be reimbursed 400 the recoverable depreciation on your original laptop. Office furniture and fixtures horses not three-year property and other property not designated a recovery periodincluding machinery not listed as five-year property. éÆGVÆ Ôø å u2½t¹ D _Øi4HÏÏL9QðÅýòäÜšpçÌïKÚPÚ ˆPÚ ³E¼âI_kP VÔ ¼ZfÍžùÝ xÇ DœÜm2 1 Ç xÝV À œTM 6n eTljø³ ÈËdEuÞx7 EìZpÿ Ë ÉºÊÄ8ÌiB2mÕóLù-8Ûàu ÎY ÅV1ZÔÅÀwØ _fe pwõOÆqfšŠEww Á_.

Stop accumulating depreciation in any year in which the depreciable cost falls below the salvage value. The depreciation table is shown below. Straight line depreciation percent 15 02 or 20 per year.

Now that EBIT has taken out the depreciation and amortization expense in the income statement it is required to add back the expense to assess the companys cash flow. You just take the assets purchase price and deduct its. How to Calculate Depreciation.

Calculate the depreciation expenses for 2012 2013 2014 using a declining balance method. Boats single-purpose farm structures. For instance solar system depreciation falls under a five-year plan for companies.

Estimated useful life of assets helps determine financial stability and profitability in your department. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. Use the equation 2 million 10 200000.

You bought office furniture 7-year property for 10000 and placed it in service on October 13 2013. This is why there are several ways to calculate depreciation. The initial cost of the asset.

While expense depreciation can take a few different forms special rules apply to solar panels. Using this example in year 4 the depreciable cost is 216. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2021 is 18200 if the special depreciation allowance applies or 10200 if the special depreciation allowance does not apply.

The expected residual value also known as salvage value - this is the value of asset at the end of its useful life which may be zero. Use declining balance depreciation. The most widely used method of depreciation Depreciation Depreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life.

Here are some of them. Depreciation rate 20 2 40 per year. The second chart the Percentage Table Guide asks for the convention month or quarter that you placed the Toyota in service.

Taxpayers were permitted to calculate depreciation only under the declining balance method switching to straight line or the straight line method. Depreciation enables companies to generate revenue from their assets while. Office furniture and fixtures farm equipment any assets that dont fit into other classes.

Here are three ways that depreciation information can impact your departments success. Rental Property Items with Faster Depreciation. Its value indicates how much of an assets worth has been utilized.

Depreciation limits on business vehicles. Section 179 deduction dollar limits. Useful life 5.

In straight-line depreciation the cost basis is spread evenly over the tax life of the property.

Depreciation Formula Calculate Depreciation Expense

Solved Furniture Costing 69 800 Is Sold At Its Book Value Chegg Com

The Original Cost Of Furniture Amounted To Rs 4 000 And It Is Decided To Write Off 5 O Youtube

Furniture Fixtures And Equipment Depreciation Calculation Depreciation Guru

9073f881de29d12e759fa75c7e355f725a5eefb3bbd463 35790442nop Png

The Book Value Of Furniture On 1st April 2018 Is Rs 60 000 Half Of This Furniture Is Sold For Youtube

Furniture Depreciation Calculator Calculator Academy

Depreciation Formula Calculate Depreciation Expense

Depreciation Nonprofit Accounting Basics

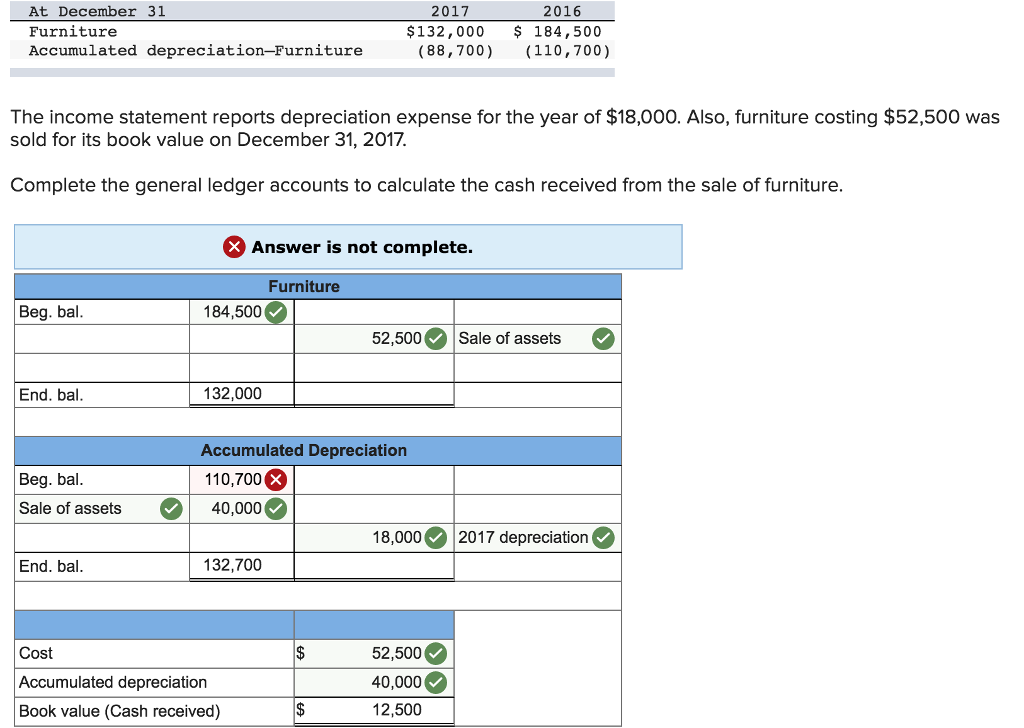

Solved At December 31 Furniture Accumulated Chegg Com

![]()

Furniture Calculator Splitwise

Accumulated Depreciation Explained Bench Accounting

Manufacturing Special Tools Depreciation Calculation Depreciation Guru

What Is The Furniture Depreciation Rate 3 Factors For The Calculation To Ergonomics

Furniture Fixtures And Equipment Depreciation Calculation Depreciation Guru

Depreciation Nonprofit Accounting Basics

How To Calculate Depreciation Expense For Business